Disturbing Commercial Bank Trends April 10, 2023

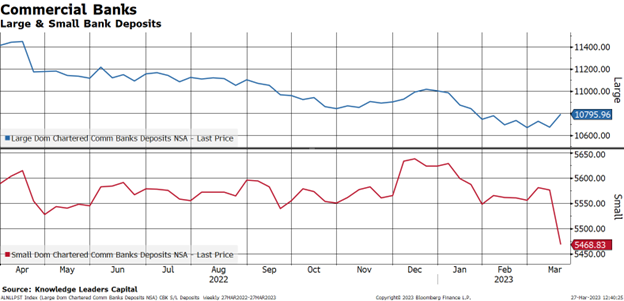

Lost in the Good Friday holiday and the jobs report was the weekly report on bank lending, deposits and securities holdings. Keeping in mind this data is always a week old, it shows the retreat from banks continues. Small banks have now experienced about $250…

Read More