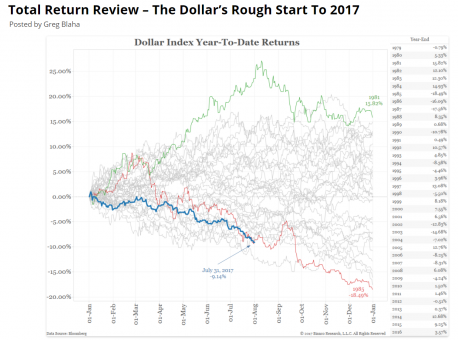

USD: Worst Start Since 1985 & TIPS How to Navigate

August 01, 2017The USD is off to its worst start since 1985, down about 9%. In the chart below (courtesy of Bianco Research), it appears the USD is tracing its performance in 1985 quite closely. Of course, 1985 was the worst year for the USD in almost 40 years, so if we stay on the current path, expect the USD to drop another 10% from here.

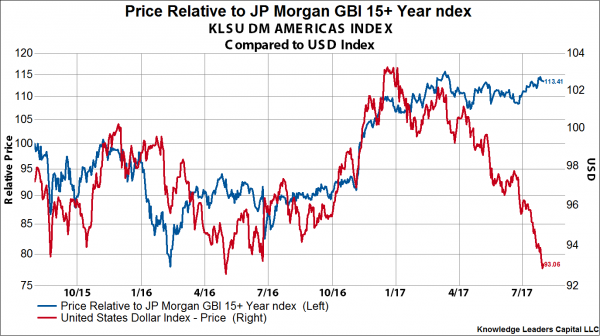

The weak USD is setting up a possibly profitable rotation out of US equities into longer dated US Treasuries. In the next chart, I take the total return of our KLSU DM Americas Index (top 85% of North American market cap) relative to the JP Morgan Government Bond 15+ Years Index. I overlay the USD, and as can be seen from the chart, the relative performance of stocks vs. bonds tracks the USD fairly closely. If the stock/bond ratio follows the USD back to its May 2016 lows, bonds could outperform stocks by about 35%.

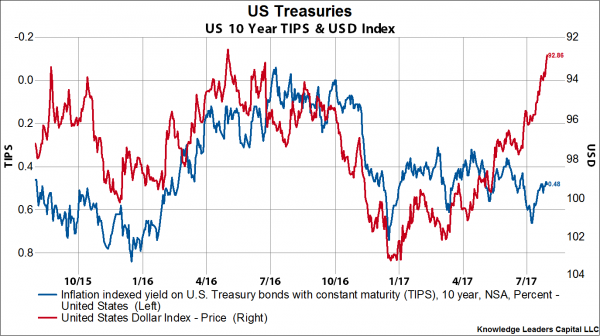

The likely mechanism is a plunge in real rates, or TIPS. In this next chart, I overlay 10-year TIPS on the USD (inverted). The last time the USD was around this level, 10-year TIPS yields were zero.

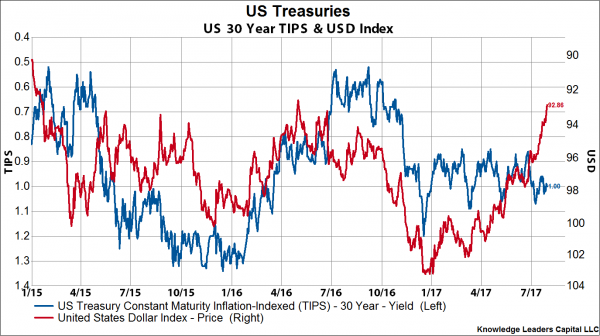

Same idea with 30-year TIPS. Here I use 30-year TIPS and overlay on the USD. The last time the USD was at these levels, 30-year TIPS yielded about 70bps.

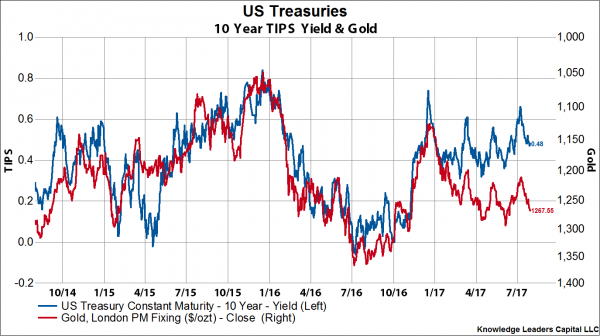

Even if breakeven inflation remained unchanged, there appears to be 30-50bps of downside to real rates based on the weaker USD. For a 30-year bond, with a 20-year duration, 30bps of downside would equate to about a 6% return. If the USD falls back into the 80s, shorter dated TIPS yields could easily fall back into negative territory. This could be what gold is sniffing out. Either gold should be at $1,150 or 10-year TIPS should already be around 20bps. If gold breaks above the June 7, 2017 high at $1,291, TIPS should follow.

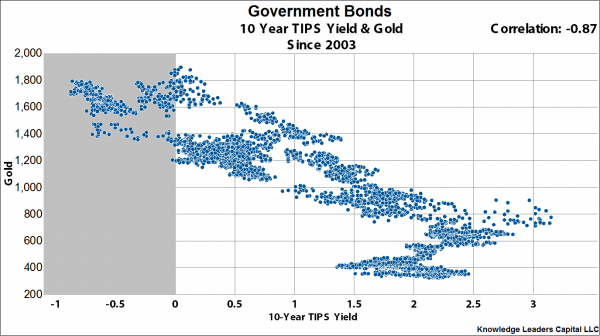

Since 2003, gold has exhibited a -87% correlation to 10-year TIPS yields. Interesting the high print on gold was in September 2011, when 10-year TIPS yielded 5bps.