Coming Challenges to US Treasury Investing

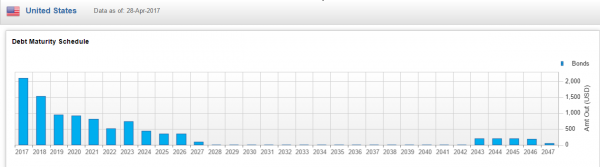

May 01, 2017In the table below we show the aggregate US Treasury maturity schedule. Due to stops and starts of the US Treasury issuing longer dated bonds over the last few decades, there is a huge gap in maturities available for investors.

The reader will notice that there are no US Treasury bonds due to mature between 2028-2042. So, as we move into 2018, what if an investor desires a 10 year bond? Or a 20 year bond? There will be nothing to choose from.

Ten year US Treasury bonds have a duration of roughly 7 years. In 2018, an investor looking to form a fixed income portfolio with a duration longer than 7 years will have to buy issues maturing in 2043-2047. Investors hoping to form a longer duration US Treasury portfolio will have to take a massive barbell approach mixing bonds that mature in 25+ years with those maturing in less than 10 years.

Given that aggregate issuance in 2043-2046 is a tad less than $200 billion/year, and in 2017 issuance so far is roughly $40 billion, the total “market cap” of these bonds maturing in 2043-2047 is less than $1 trillion.

As 2018 approaches, all fixed income investors who have need to maintain a longer duration fixed income portfolio (ie, insurance companies, pension funds, etc.) will be forced to buy a relatively small pool of US Treasury securities.

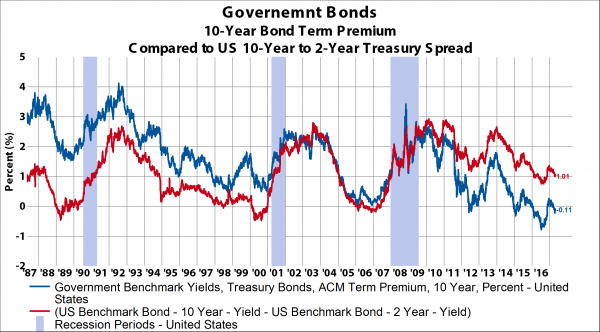

This dearth of duration may be the reason the ACM Term Premium is so low. Recent FRB articles have suggested that the term premium is suppressed by roughly 100bps by past quantitative easing. This may explain why the current term premium is around 110bps lower than is suggested by the spread between 10-year and 2-year US Treasury bonds. But, the low term premium may also reflect the complete absence of longer dated risk free assets.

Historically, the yield curve flattens prior to a recession (1990, 2000, 2007) using the 10-year to 2-year US Treasury spread. While the nominal curve isn’t inverted (yet), the ACM Term Premium is negative which should at least give the reader pause when considering the possibility that the bond market may be suggesting a less robust economic environment in the years to come.