How to Play the Gold Break-Out in Fixed Income Markets

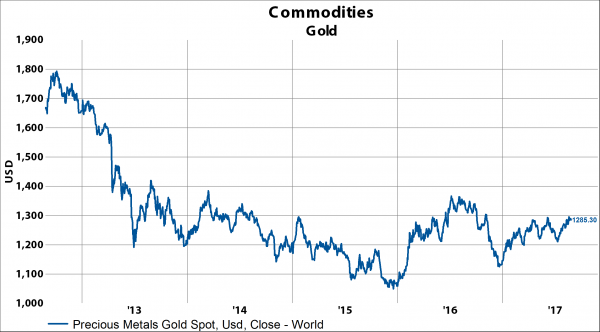

August 28, 2017Today gold is trading over $1,305, for the first time since November 4, 2016.

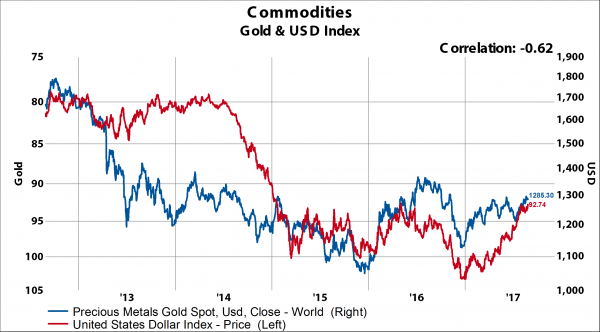

The breakdown in the USD Index last week was a good signal telegraphing the short-term breakout in gold.

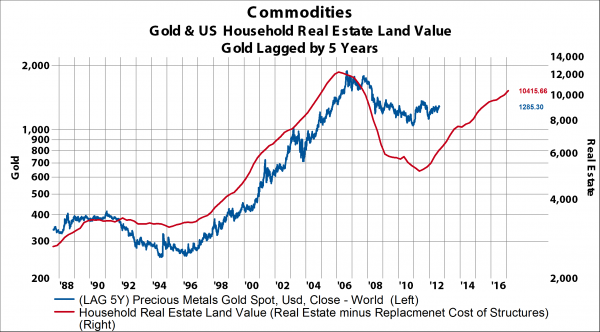

Gold is notoriously difficult to value, but we have found one relationship that seems to consistently work. In the Flow of Funds, we can distill the aggregate value of land in the US by the household sector.

We subtract the nominal value of household real estate from the replacement cost of structures to arrive at the land value of US household real estate. The value of land in the US held by the household sector—a similar asset to gold that doesn’t yield anything per se—tends to lead the value of gold by about five years. Given the increase in land values in recent years, gold should be finding a more solid footing and trending up for the next few years.

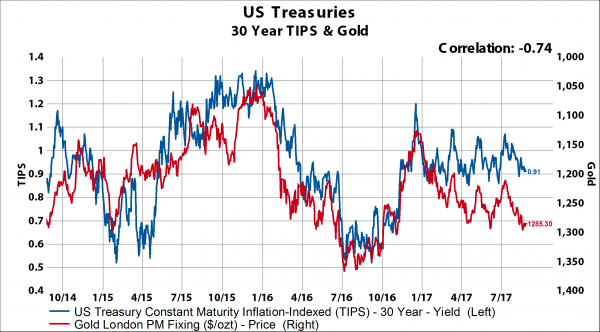

In addition to buying gold, gold stocks are always another way to play an increase in gold prices. A couple other ideas in the fixed income realm are: 1) longer-dated TIPS in the US, 2) Australian bonds, 3) Canadian bonds, and 4) longer-dated fed funds futures.

A move in gold back to $1,350 should correspond to a 40bps move down in 30-year TIPS, which with a duration of around 25 years, would correspond to a 10% increase in price.

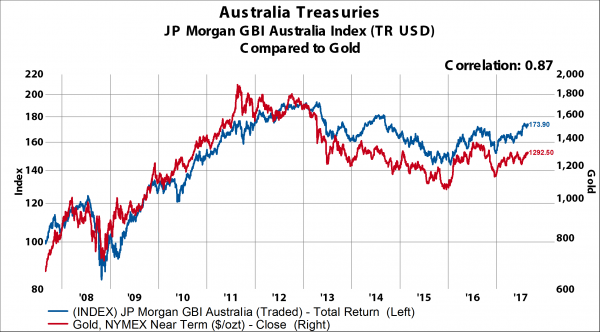

Australian bonds, represented by the JP Morgan Government Bond Index, in USD, should also have a good response to higher gold prices.

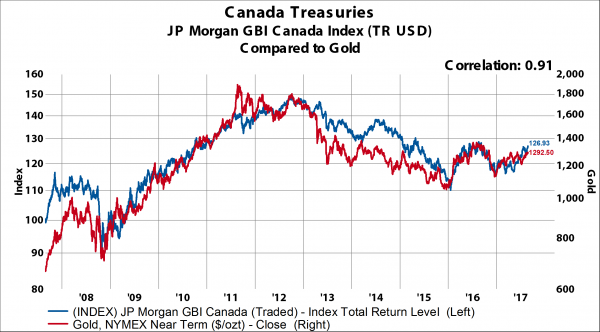

Same idea when we look at Canadian bonds.

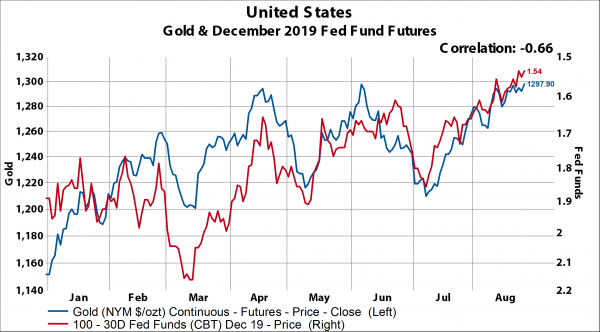

December 2019 Federal Funds futures began trading in January of this year. Rates implied in the December 2019 Fed Funds futures contract have fallen from a high of 2.1% in March to 1.54% currently. So, prices have risen from 97.9 to 98.46 since March.

The information presented here is for informational purposes only and is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Please see full disclosures on the blog home page.