Beware! Estimates Dominate Financial Reports

October 18, 2018Estimates Are Hazardous to Your Wealth.

Everyone knows that accounting is boring (not when I teach it, though), but, at least, people think it’s factual. No fake news. After all, accounting comes from counting―counting money, units of inventory, etc. All facts. Nothing further from the truth.

Except for a few items on the balance sheet, like cash and debt, practically all items on the balance sheet and the income statement are based on managers’ subjective estimates and projections. Hard to believe? Here are examples:

- Fixed assets and goodwill are presented on the balance sheet net of depreciation and amortization, both are managerial estimates.

- Accounts receivable (money owed by customers) are presented net of the bad debt reserve (expected non-payments)―again, an estimate.

- Inventories are often presented at market (replacement cost) value―an estimate.

- The pension expense―a big item for labor-intensive companies―is based on 4-5 different estimates (e.g., future wage increases, future gains on pension assets, etc.).

- Employee stock options expense too is based on 3-4 assumptions.

You get the point: There are hardly any facts in the information―assets, earnings― you receive quarterly from public companies.

Many of these estimates are no better than sheer guesses. Take, for example, the “gain on pension assets,” mentioned earlier. This key determinant of the pension expense requires managers to estimate the future (3-5 year) market performance of the funds set aside to cover retiree pension payments. Consider: Managers are asked to estimate the performance of capital markets over the next 3-5 years. Good luck estimating the market performance tomorrow.

How influential are these estimates on financial items? Often very influential. Take General Electric (GE), which again is in the news, firing on September 30 its 14 months old CEO, John Flannery. I went to GE’s last financial report before things came apart for GE: Its 2016 annual report. For that year, GE reported a hefty profit of $8.176 billion (against a loss of $6.145 billion a year earlier). This huge turn of events seemed a bit strange to me, so I dug into the footnotes. Lo and behold, I saw in Note 9 the following statement: “Contract assets increased $4,006 million in 2016, which was primarily driven by a change in estimated profitability within our long-term product service agreements …”

I am sure this sounds Greek to you (no offense). So, here is what apparently happened: GE estimates future profits on long-term contracts (turbines, nuclear generators, etc.) and reflects them in an assets, called “Contract Assets,” which is presented on the balance sheet (to the tune of $25.2 billion in 2016). But in 2016, GE’s management decided that future profits from these long-term contracts are going to be higher than past estimates by $4 billion. This managerial estimate, to the best of my understanding, enhanced reported earnings by the same amount. Namely, almost half of GE’s $8.2 billion net earnings for 2016 came from a change in managers’ estimates.

If you think that estimates affect only GE’s results, you are wrong. They seriously affect every company, and what’s worse―they are fast growing, because the FASB (U.S. accounting rule-maker), and IASB (international rule-maker), in their great wisdom, increased exponentially the number of estimates underlying financial reports by their constant expansion of “fair value accounting” and other estimates-based rules.

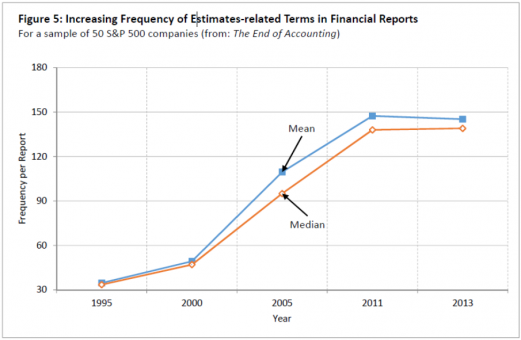

The figure below (from “The End of Accounting”) shows that whereas in 1995, an S&P 500 company had, on average, 30 mentions of the terms estimates, assumptions, forecasts, etc. in a financial report, this number mushroomed to 150 in 2013 (five-fold increase!).

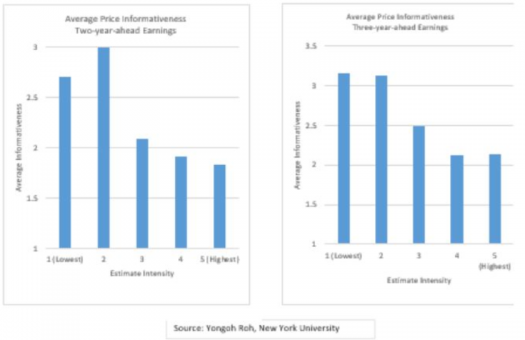

And what is the effect of all these estimates on the quality/reliability of financial reports? In one word: devastating. The following figure, from Yongoh Roh, an NYU Ph.D. student, shows “share price informativeness”―namely, the ability of share prices to predict, or reflect future corporate performance―for all public companies, classified by estimates-intensity (increasing from left to right). It is clear that with respect to two-year ahead (left figure) and three-year ahead earnings (right figure), the ability of share prices to reflect future performance decreases sharply with the number of estimates underlying financial reports.

The reasons for the detrimental effects of managerial estimates on the values in financial statements are twofold: First, all estimates/forecasts are subject to errors, particularly in the turbulent business environment. Second, estimates are frequently manipulated by managers to show better results or meet analysts’ estimates. You can never nail down managers for misestimation. Even if subsequent facts show that the estimates were seriously off mark, managers will say that at the time they made the estimates they were based on their best information. Good luck disproving this.

So, what’s an investor to do with the current financial reports which are literally floating on a sea of doubtful estimates? Here are my suggestions:

As is generally the case with corporate financial reports, they hide more than reveal (and that’s why managers are happy with these reports despite their loss of relevance―see The End of Accounting). You have to be a sleuth to identify the influential estimates affecting earnings. Here is a brief, painless tutorial.

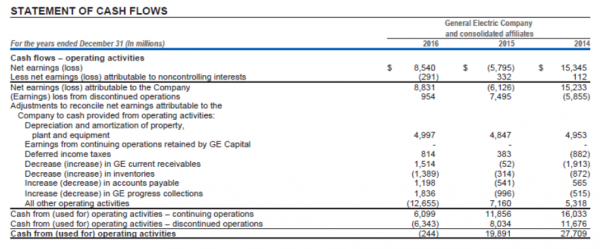

Managerial estimates are revealed in the cash flow statement which converts earnings to cash flow. Since estimates affect earnings but don’t involve cash receipts or payments, they have to be flushed out (reversed) in the cash flow statement. See, for example, GE’s cash from operations statement below. It starts (for 2016) with earnings of $8.54 billion and ends with “Cash from operating activities” of negative $244 million. In between the two sums you see the main non-cash items, mostly estimates, like depreciation ($4.997 billion), or deferred taxes ($814 million). The last item above the line―“All other operating activities”―a whopping, negative $12.655 billion, is subtracted from earnings (see parentheses indicating a negative number) because it increased earnings, but not cash flows. Various estimates are included in this large item.

A search of GE’s footnotes reveals that indeed, the $12.655 billion earnings increase includes the $3.929 billion estimated increase in “Contract Assets” mentioned earlier. End of tutorial.

So, dear investor, before you get excited with a “good” earnings report disclosed by a public company, have a careful look at the top panel of the company’s cash flow statement―Cash from operating activities. Examine carefully the items listed between earnings (top line) and cash flows (you can ignore the increases/decreases in working capital items, such as inventory and accounts payable). If you notice a large amount that wasn’t there in previous years, particularly amounts in parentheses (meaning that they have increased earnings), be very suspicious about the economic relevance of the “good earnings.” If such unusual estimates are more than 20-25% of bottom-line earnings, ignore earnings altogether. There may be good, valid reasons for such large estimates, but since these reasons are rarely fully disclosed to you, better be safe than sorry.

Baruch Lev is the Philip Bardes Professor of Accounting and Finance at the Stern School of Business, NYU. This article first appeared at the Lev End Of Accounting Blog and is shared here with his permission. Professor Lev is not affiliated with Knowledge Leaders Capital and his opinions are his own.