Could This Be a Brutal Earnings Season? If So, How Should One Be Positioned?

July 11, 2019Yesterday BASF, the largest chemical company in the world, announced its earnings would fall well short of analyst estimates in the second quarter. Earnings season in the US begins in a few weeks. So, we ran through our charts to harvest any insights about how corporate earnings may play out.

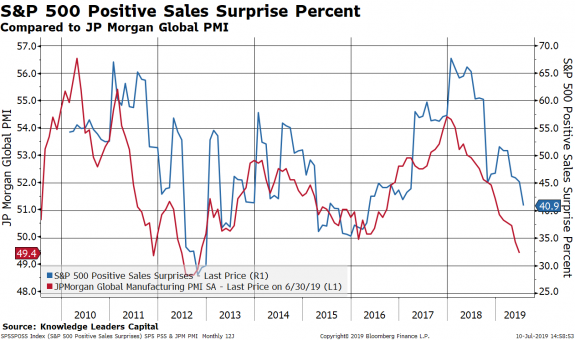

I’m afraid the results are not what most investors want to hear: 2Q earnings season could be pretty ugly. First, I look at the percent of S&P 500 companies reporting positive sales surprises against the JP Morgan Global Manufacturing PMI. Given the deteriorations in the JP Morgan PMI—which is now below 50—we expect to see a dwindling percent of companies beating on the top line.

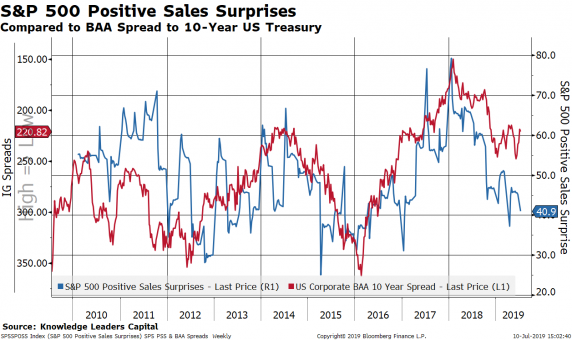

Historically the percent of companies reporting a positive sales surprise is correlated to credit spreads, in particular BAA spreads. In this next chart, I overlay the percent of S&P 500 companies reporting positive sales surprises against BAA spreads. This suggests credits spreads could potentially continue widening, making corporate bonds maybe not the ideal alternative to stocks in a stormy earning season, in our opinion.

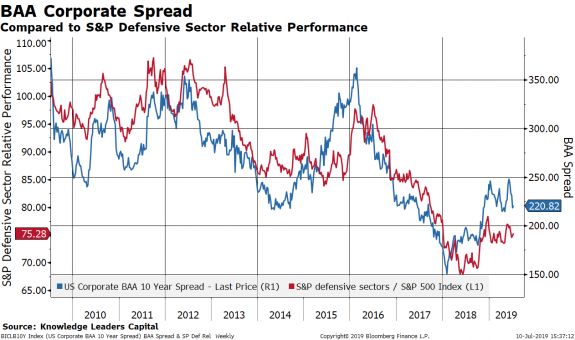

When credit spreads contract, the defensive sectors of the S&P 500 tend to underperform (2012-2014 or 2016-2018). And, when credit spreads widen, defensive sectors tend to outperform. So, from an equity standpoint, it may be time to be pretty defensively positioned.

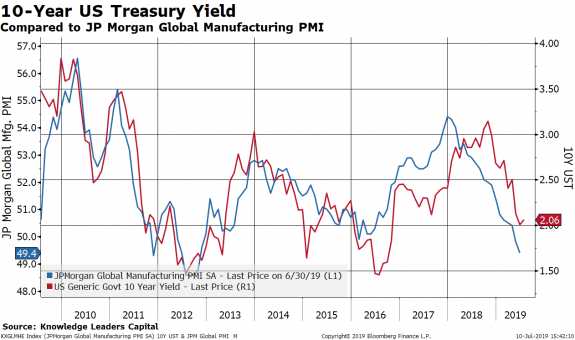

Lastly, longer duration US government bonds tend to outperform when the JP Morgan Global Manufacturing PMI is declining. The last time the JP Morgan Global Manufacturing PMI was under 50, like today, 10-Year US Treasury yields were about 1.75%. Should the JP Morgan PMI fall just 0.4 further to 49, it opens the door to a move down to 1.5% in 10-Year US Treasury yields … even challenging the record low yield set in 2016.

Unless or until leading economic indicators like the JP Morgan Global Manufacturing PMI bottom and turn up, we believe portfolio positioning should focus on US Treasuries and defensive stocks.

As of 6/30/19, BASF was held in the Knowledge Leaders Strategy.