Confirmation of the Deterioration in Consumer Confidence

September 25, 2019In our mid-quarter update, we highlighted the plunge in the University of Michigan’s consumer confidence indicator, suggesting that “good feelings” among consumers were starting to fade. Often surveys offer a leading glimpse into economic activity. A more confident consumer is more likely to make those big-ticket purchases, like homes and cars, as well as consuming more services.

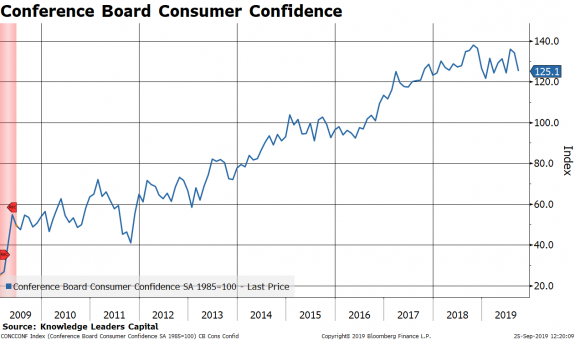

Earlier this week, we got the latest reading of the Conference Board’s version of their consumer confidence indicator. It came in at 125.1, missing expectations of 133.2.

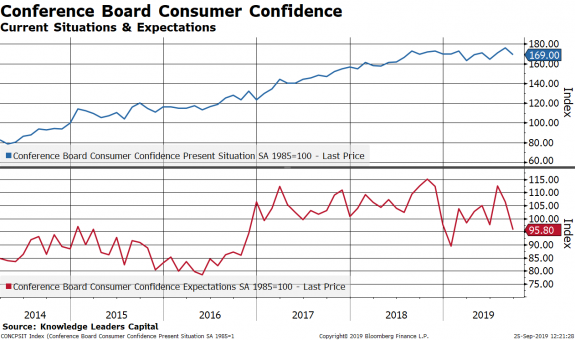

While consumer’s assessment of their present situation fell slightly, it was consumer’s expectations for the future that took a big hit.

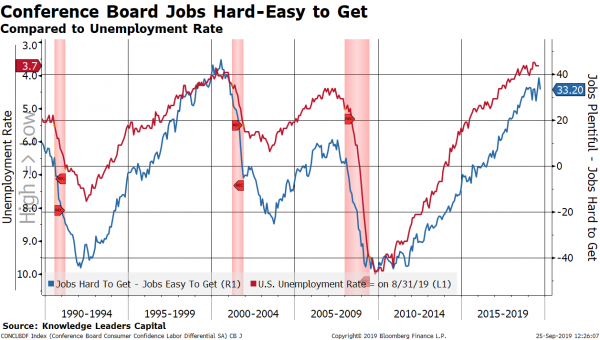

Crawling through the details of the report, there was at least one interesting detail. The Conference Board will survey people if jobs are hard to get or plentiful. We have a simple indicator where we take the percent of respondents that say jobs are plentiful and subtract the percent of respondents that say jobs are hard to get. This indicator correlates pretty well with the unemployment rate going back over the last 30 years. In the last month, the jobs indicator dropped by more than 5 points. The unemployment rate troughed at 3.6% in April. Historically, peaks in the jobs indicator occur concurrent to lows in the unemployment rate.

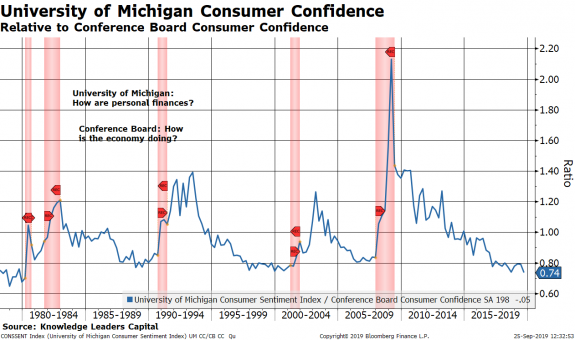

Comparing the University of Michigan also yields an interesting tidbit. The University of Michigan asks respondents how their personal finances are, while the Conference Board asks respondents how the economy is doing. Often, recessions are preceded by troughs in the University of Michigan to Conference Board ratio. The logic here is that prior to a recession, consumers feel good about their finances because they still have a job, but see storm clouds on the horizon that may negatively impact the economy.