Competitive Dynamics in the US Fund Management Industry

June 12, 2015ETF Trends reported the other day that total ETF assets under management are expected to double by 2020, translating into roughly $740 billion per year of flows into ETFs (link to story here). If we look at just equity related ETFs, the growth dynamic is easy to see. All categories of equity ETFs have seen strong growth over the last decade. In the chart below we show assets under management by various equity ETF categories. According to ICI data, in total, equity ETF assets have doubled since 2010, which makes another doubling int he next five years somewhat of a simple extrapolation.

ETFs are taking a bit out of the mutual fund industry. In “Outflows Take a Toll on Waddell and Reed” (see link here), Ivy Funds recent struggles are highlighted. Indeed, again using ICI data, we calculated the cumulative five years net flows into equity funds that strive for capital appreciation. Over the last five years, such funds have experienced almost $400 billion in outflows. The lesson is clear that ETFs are having a big negative impact on traditional equity mutual funds.

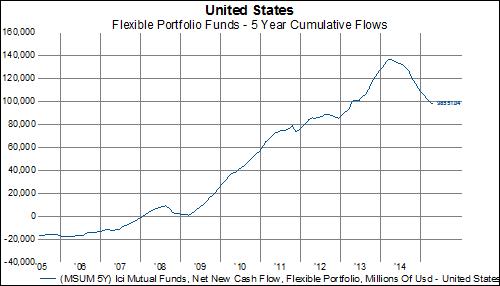

Some types of funds have withstood the new competitive dynamic quite well however.. Flexible portfolio funds. otherwise known as balanced, allocation or multi-asset funds, have experienced consistent net inflows over the last decade. In particular, such funds have done quite well attracting inflows over the last five years while ETFs have blossomed. Cumulative net flows are off the highs set a year ago, but flexible portfolio funds continue to attract assets despite ETF competition.

Competitive dynamics in the US fund management industry suggest the proliferation of ETFs has been a double edged sword. For equity only funds, things have been difficult , and the benefits of ETFs–from lower fees and taxes, to greater liquidity and transparency–have led to declining market share of assets under management. For balanced or allocation funds, we would argue the proliferation of ETFs has had a beneficial impact on flows as investors seek out managers that have the greater skill to generate superior risk adjusted returns.